It is essential to pay tax in Canada if you are a worker of Canada and possess lawful freedom to get employed in Canada. This article will explain how to pay your income tax and tax return in Canada.

Table of Contents

How to File Taxes in Canada

Income tax in Canada

The Canada Revenue Agency oversees the administration of income tax in Canada. The income tax year in Canada is from 1 January to 31 December. If you are in debt of the income tax, make an effort to pay before 30 April for the last calendar year. Late presentations are authorized; however, there are usually effects. If you are employed in Canada, income tax will taken out from your income by your employer, and the funds will be forwarded to the Canada Revenue Agency.

For them to take out the adequate income tax from your salary, your employer will direct you to complete the form TD-1. Employers are accountable for deducting a sum from each reimbursement cheque for the Canada Pension Plan (CPP) and Employment Insurance. You own every freedom to decide your income tax status and make payment of the accurate sum of tax.

What You Require to File a Tax Return in Canada

You will require maybe:

- A social insurance number

- An Individual Tax Number

Having obtained a SIN or ITN, input it in your SSC account to enable UBC to offer the administration the correct information for your taxes.

When you have any of these numbers that have expired and you are not presently working for any employer, the expired number can be used for filing your taxes.

Social Insurance Number

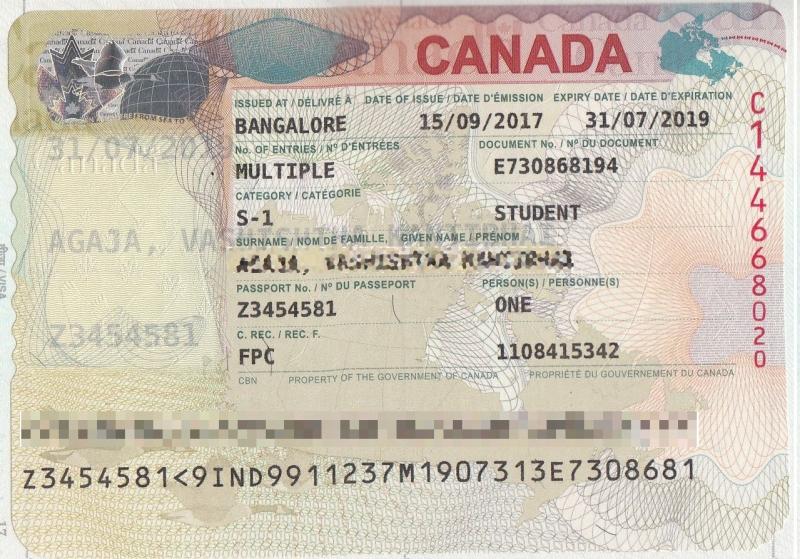

To apply for a Social Insurance Number, you must have a work permit or an on-campus employment offer with an authentic study permit.

Individual Tax Number

If you are not qualified to apply for a Social Insurance Number, apply for an Individual Tax Number. This is common for scholarship students since UBC will need you to offer an Individual Tax Number after Term 1.

Note: Make sure you do not make an application for an Individual Tax Number after February since it can take up to one month or more. You can forward your Tax Number request and the tax return to the address stipulated on your Tax Number form.

Should you find this piece engaging, we kindly invite you to explore the wealth of content in our other articles:

Additional Accompanying Documents When Filing Taxes

- T2202A: the tax year tuition payments are reimbursed. This can be obtained from the Student Service Center.

- T4: Employment wages and reductions. You may ask your employer to provide you with this.

- T4A: this has to do with bursaries and scholarships

- General Tax Forms are available online and at every Canada post office.

Application For Tax Reductions

You may possess the right to reduce specific costs from your tax reimbursement. This cost may include:

- Storage and commutation of personal impacts

- Travel costs

- Temporary lodging may be regarded as qualified reductions.

Make sure to save your receipts for the expense of immigrating to Canada. Hence, you can not reduce moving costs if your only salary at the new place is scholarship, fellowship, or bursary revenue that is wholly excluded from tax under the present legislation.

How to File Your Taxes

- By paper: this will require you to complete and present the form on paper.

- By online

- By mail: When you present your first tax return, you are required to forward your return to the International Tax Service office, returns processing division, 2204 Walkley Road, Ottawa, ON, K1A 1A8. If this is not your first filing for a tax return, you may be required to make an application online or forward it to the local office at the Canada Revenue Agency.

A Tax Return is Required to be File if You

- Are forwarding income tax to the administration, for instance, if you earn a big salary in Canada

- The Canada Revenue Agency has demanded that you file a return.

If You do Not Owe Any Tax, You are Required to File a Tax Return if You

- Anticipate an income tax payback from the authority.

- Are making an application or plan to apply for the GST and HST credit, which offers cash reimbursements of the tax to low- and middle-income taxpayers to assist in reducing the expense of paying GST and HST on taxable buying.

- We might achieve additional revenue in Canada later and want to continue. This implies saving for the future year’s Tuition Payments and Education Credits to decrease the tax you owe in years to come.

The people on scholarships, bursaries, or fellowships are not required to pay taxes on their earnings; however, they must give UBC their Tax Number or Social Insurance Number when they demand it for tax intentions.